CONTACT US

Schedule Your FREE

Home Damage Inspection

or Claim Evaluation

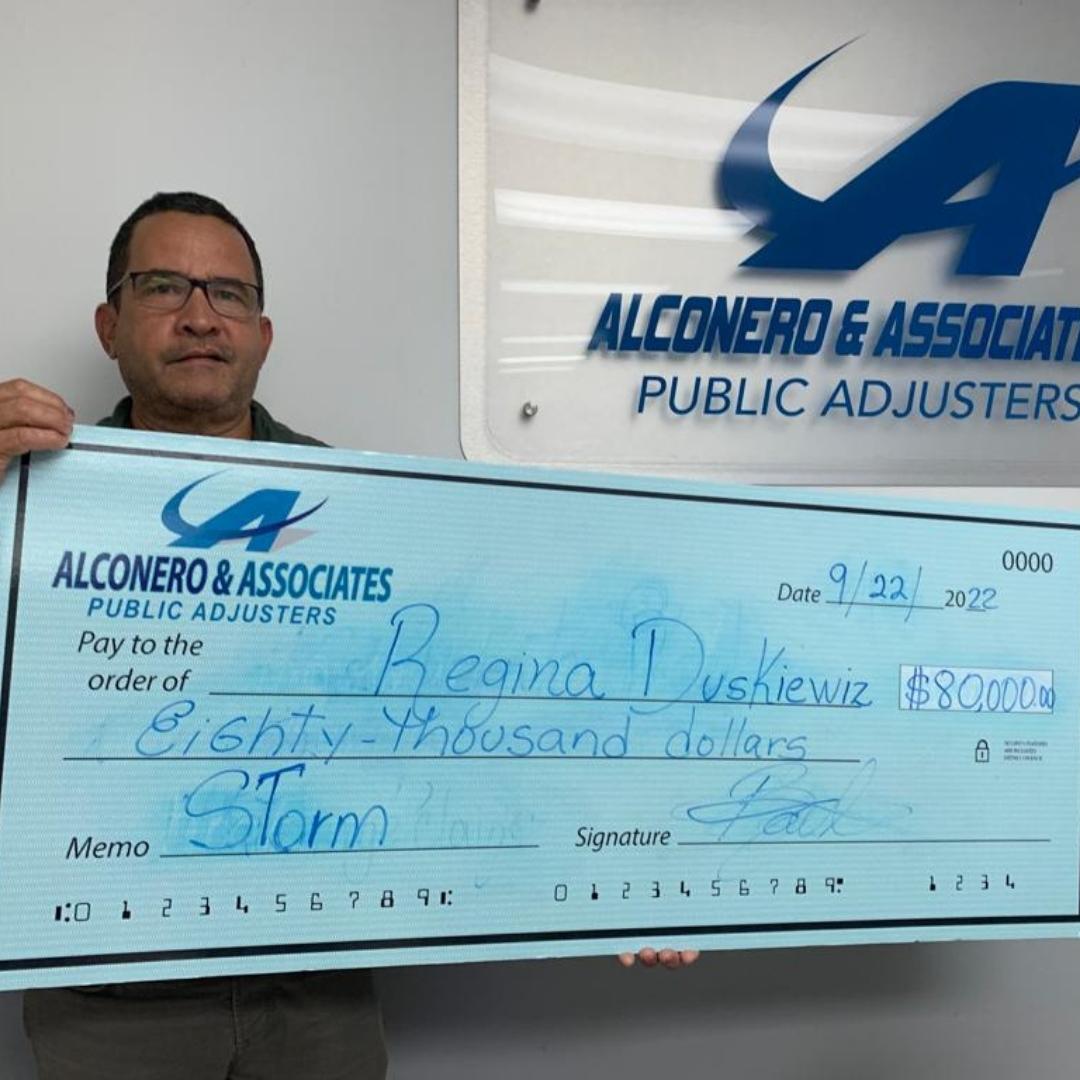

Recent Payout Settlements

$22,500

$10,000

$80,000

$24.909

$32,500

$41.250

Best Public Adjusters in Miami and Fort Lauderdale

Experience the Best Public Adjuster Services in Miami and Fort Lauderdale

Maximizing Your Property Damage Insurance Claims in Miami and Fort Lauderdale

The Best Public Adjuster in Miami, Fort Lauderdale and Palm Beach

Welcome to Alconero and Associates, the best Public Adjuster in Miami, Fort Lauderdale, and Palm Beach. We are more than just a public adjuster; we are your steadfast ally during the insurance claim process. Our team of certified appraisers, with over 60 years of combined experience serving Florida residents, is dedicated to helping you get the most out of your claim for lost or damaged property.

We specialize in a wide range of property damage insurance claims including Hurricane Damage, Theft / Vandalism, Water Damage, Fire Damage, Roof Leak Damage, Flood Damage, Mold Damage, and Loss Of Business Income. Our goal is to ensure you receive the maximum settlement you are entitled to. We achieve this by performing the correct evaluation and documentation of the damages.

At Alconero and Associates, we believe in prompt and efficient service. That’s why we offer a free inspection on the same day. Trust your insurance claim process to the best Public Adjuster in Miami, Fort Lauderdale, and Palm Beach. Experience the Alconero and Associates difference and get the most out of your insurance claim!

If you’re looking for a “public adjuster near me” to handle your property damage claims, whether it’s water damage, mold damage, fire damage, smoke damage, flood damage, burst pipe damage, hurricane damage, storm damage, or underpaid claims, look no further than Alconero and Associates. Learn more about us and how we can help you today.

Experts in Insurance Claims

We evaluate existing insurance policies in order to determine wha coverage may be applicable to a claim.

Research

We investigate all detail, and substantiate damage to buildings and contents and any additional expenses. We also evaluate business interruption losses and extra expense claims for businesses

Damage Determination

We can determine values for settling covered damages. We will prepare, document and support the claim on behalf of the insured.

Negotiation

We negotiate a settlement with the insurance company on behalf of an insured,

negotiating dollar values and if not able we continue to appraisal or mediation.

Amount Awarded For Clients

Cases Won In Court For Clients

Cases Submitted To Insurance

The Insured Did Not Seek Legal Advice

THE BEST PUBLIC ADJUSTER IN MIAMI FIGHTING FOR YOU!

Seeking assistance for your claim settlement? Look no further! At Alconero and Associates, we strive to secure the maximum payment for property claims arising from a variety of losses, including fire, water, vandalism, wind, ceiling leaks, floods, mold, and loss of income, among others. Our insurance claim specialists stand ready to work alongside you, ensuring you recover the maximum amount possible. We’re not just a public adjuster in Miami – we’re your dedicated partner in navigating the complexities of insurance claims.

What is a Public Adjuster in Miami and Fort Lauderdale?

A Public Adjuster in Miami is a professional insurance claims manager. These experts are hired to file, document, and advise on insurance claims. They represent the insured during the process of assessing a claim’s worth and validity, and negotiate with the insurance company to secure the claimant the largest possible settlement. Essentially, a Public Adjuster is an advocate for the insured, ensuring that claims are correctly submitted and processed. They then work with the insurer to obtain a higher payout for the insured.

At Alconero and Associates, we embody this role, providing top-tier public adjuster services in Miami. If you’re searching for a “public adjuster near me”, look no further. Our team of experienced professionals is dedicated to helping you navigate the complexities of the insurance claim process, from filing to negotiation. Trust us to be your advocate and secure the maximum settlement you’re entitled to.

Get a FREE Inspection

Reach Out to Us Today

In need of assistance for a fair claim settlement? Look no further! At Alconero and Associates, we specialize in securing maximum property claim settlements for damages due to fire, water, wind, and mold. If you’re searching for a “public adjuster near me”, you’ve found the right place. Our team of insurance claim specialists is ready and eager to work with you, ensuring you recover the maximum amount possible from your claim. Don’t hesitate, contact us today and let us help you navigate the complexities of the insurance claim process.

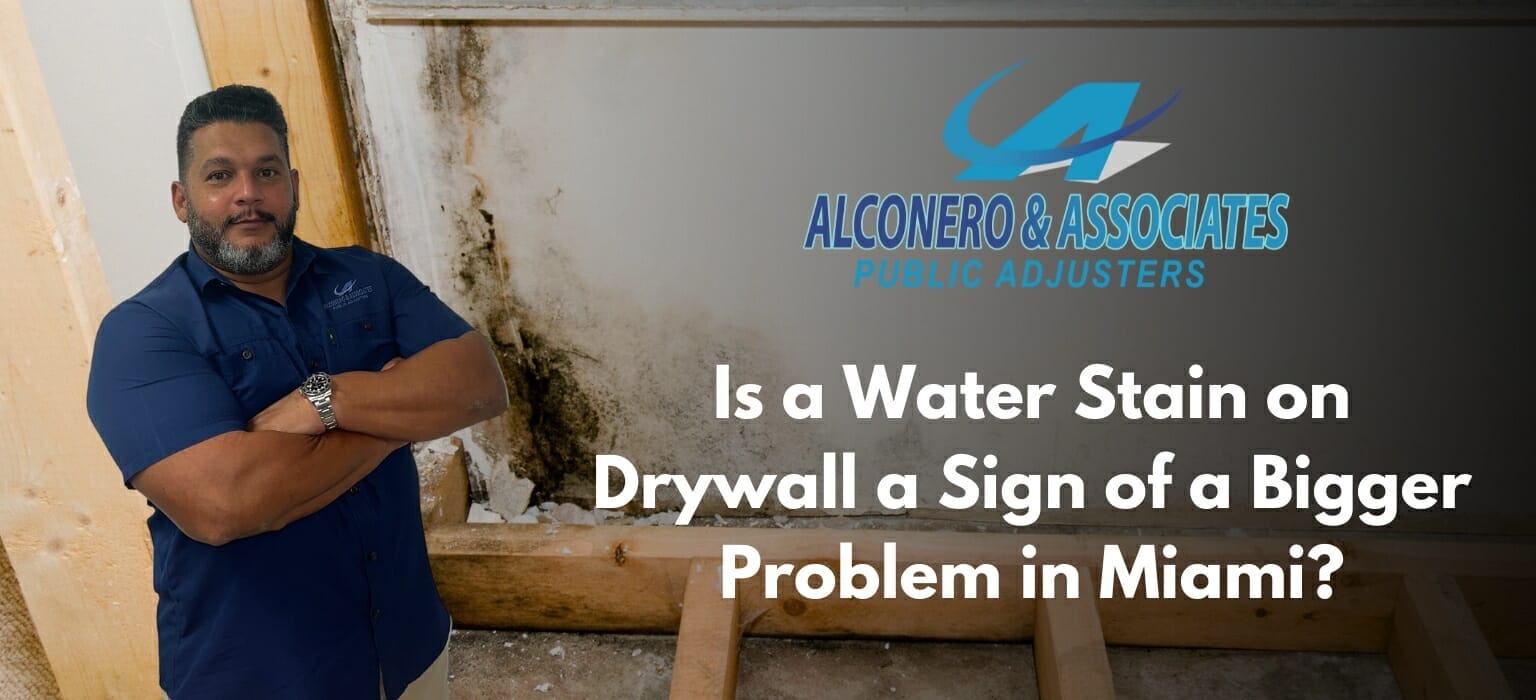

Alconero and Associates Best Public Adjuster in Miami Blog

Navigating the world of Public Adjusting doesn’t have to be a maze. Stay informed with the latest tips, news, and insights from Alconero and Associates, your trusted “public adjuster near me” in Miami, Florida. Our blog is designed to empower you with knowledge, making the insurance claim process less daunting. Dive in today!